Business Insurance in and around Virginia Beach

Looking for small business insurance coverage?

No funny business here

Your Search For Reliable Small Business Insurance Ends Now.

Whether you own a a clock shop, a confectionary, or a bakery, State Farm has small business insurance that can help. That way, amid all the different moving pieces and decisions, you can focus on your next steps.

Looking for small business insurance coverage?

No funny business here

Surprisingly Great Insurance

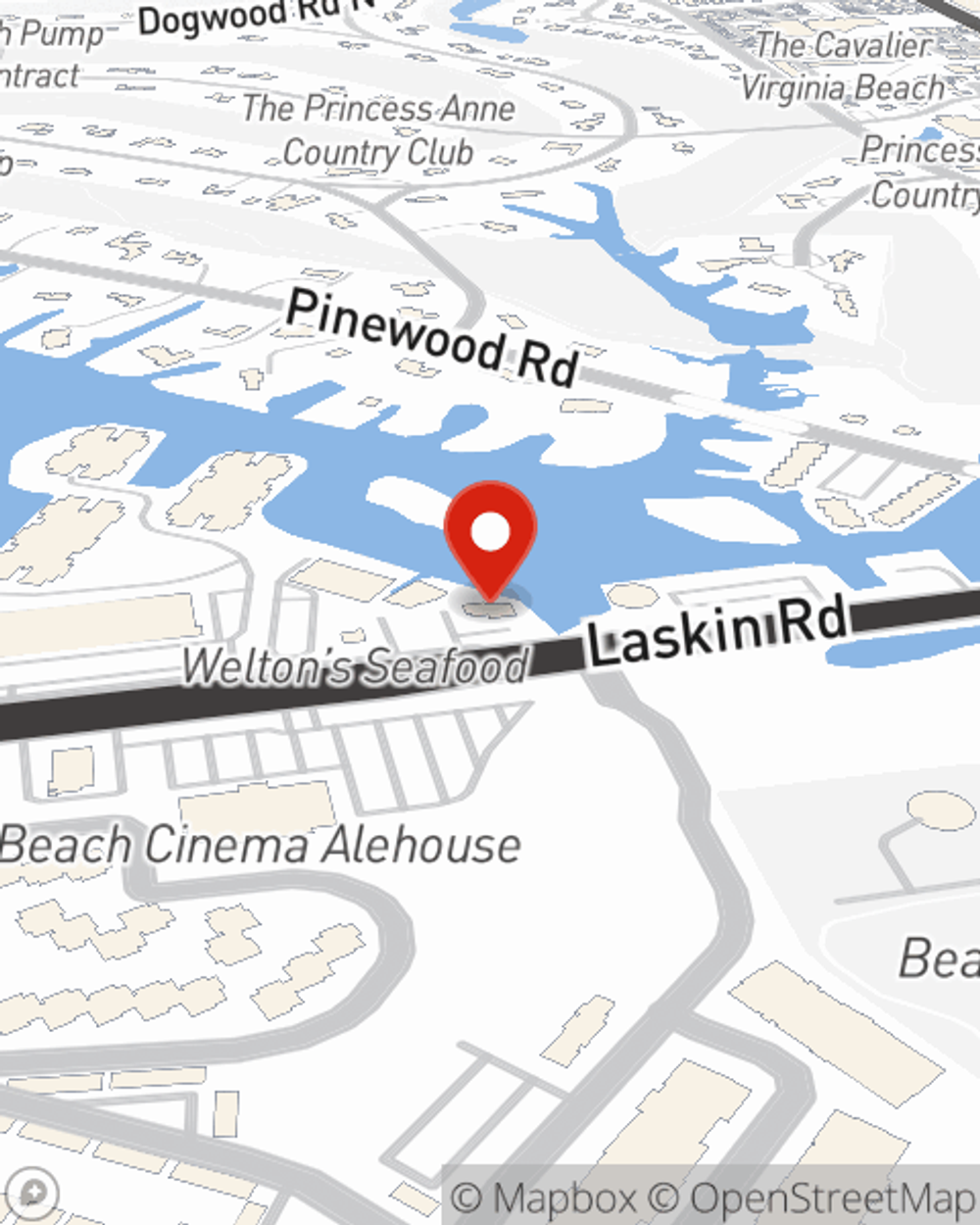

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Dennis Hurst. With an agent like Dennis Hurst, your coverage can include great options, such as business owners policies, commercial liability umbrella policies and commercial auto.

The right coverages can help keep your business safe. Consider stopping by State Farm agent Dennis Hurst's office today to learn about your options and get started!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Dennis Hurst

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.